Syria Update

8 June 2020

Table Of Contents

Download PDF Version

Self Administration bids to corner grain market as SYP collapses

In Depth Analysis

On 6 June, the Self Administration issued two decisions that effectively prohibit the sale of grain to rival territorial actors. The decisions follow significant turmoil in Syrian grain markets that come as all territorial actors in Syria have scrambled to maintain competitive grain pricing amid the increasingly rapid collapse of the Syrian pound. On 30 May, the Self Administration announced that it had substantially increased the price it will pay Syrian farmers for bulk wheat by raising the price from 225,000 SYP per ton to 315,000 SYP per ton. The following day, the Government of Syria responded in kind and raised its wheat bid to 400,000 SYP per ton. Both the Salvation Government and the Syrian Interim Government have also announced new prices, all of which represent substantial nominal increases over bids announced in April (see: Syria Update 27 April). However, the rapid currency depreciation that is the primary driver of these adjustments has continued. As a result, on 7 June the Self Administration announced that currency volatility would force it to fix the grain price according to a dollar conversion, but it is not clear how exactly this will be put into effect at harvest time.

Looking ahead, two key dynamics in Syria’s grain markets have explosive potential to affect the conflict. The more important of these concerns is the uncertain grain supply to Government of Syria areas. The second relates to the financial tolerance of wheat farmers who may be compelled to sell their harvest, potentially at below-market values.

The need for seed

The Government of Syria faces a multitude of daunting barriers to wheat procurement. Among these are production issues ushered in by the destruction of agricultural value chains, shifts from small-holder support to market-based interventions, and changes to agricultural financing. However, the foremost issues now coming to bear are the loss of physical control over Syria’s richest wheat-producing regions and the inability to finance wheat bought on the international market due to the state’s crumbling finances and the loss of Lebanon as an efficient financial conduit. Wheat grown domestically in Syria is significantly more critical to the Government of Syria’s strategic food security as a result, especially because wheat aid promised by Russia has been minimal.

Wheat procurement is now an acid test of the Government of Syria’s functional capacity. As Damascus is learning, it is expensive to be poor. Somewhat counter-intuitively, the Government of Syria’s inability to buy wheat abroad leaves Damascus with little choice but to outbid its rivals for wheat grown in areas of Syria that are outside its control. This creates a vicious circle that will only aggravate the state’s underlying insolvency. In May, the Government of Syria reportedly announced that it had budgeted 450 billion SYP, approximately 11 percent of the state budget, for wheat procurement. By nearly doubling the purchase price of wheat, authorities will be forced to make a commensurate adjustment in the budget — if it will have access to wheat at all. Several outcomes are likely. Of note, other basic services and administrative functions will likely be cut as a result. Funding the state budget may also force further increases in the money supply, thus risking greater inflation that the immiserated Syrian population can ill-afford to bear. These problems will be especially acute if inflation continues to drive grain prices higher before the harvest begins in earnest later this month.

Grain monopoly gambit

For its part, the Self Administration is taking a significant risk vis-a-vis local farmers. A majority of Syria’s wheat is grown in Self Administration areas, and the Self Administration will therefore be the focus of agriculturalists’ resentment if it seeks to carry out the grain monopoly gambit. Similar restrictions have been announced in previous crop seasons, but dissent from farmers was instrumental in the measures’ ultimate revocation. However, this is a particularly dangerous time to impose such conditions. Syria is in the midst of a severe economic shock, and the Syrian pound registered a loss of more than half its parallel market value in a single week. Already, farmers have threatened to burn their crops rather than sell them at a loss to local authorities. Meanwhile, crop fires — variously attributed to conflict actors — have also raised tensions. Now, local sources indicate that farmers are already speculating that the Self Administration’s strategy is to sell excess wheat it purchases from farmers to the Government of Syria, and to profit from the arbitrage. Such a scheme would further alienate producers. Of note, market volatility and accelerating inflation are likely to have an especially pronounced impact on cash-crop agriculture, due to the reliance on lump-sum payments at harvest time as well as the complications of long-term financing.

Looking ahead

To date, wheat and oil have been the two most important avenues for pragmatic trade cooperation between the Self Administration and the Government of Syria. Basic service agreements between the actors have existed throughout the conflict, and the opening of a critical section of the M4 highway in late May was a signal that tensions between the actors had dissipated somewhat, even if talks over a grand bargain to amalgamate the areas had seemingly stalled and both parties had hardened their positions. The Self Administration’s new announcements may jeopardize the M4 deal, which is ostensibly guaranteed by Russia. However, it is also possible that the Self Administration’s apparent bid to establish a grain monopoly is a negotiating tactic to gain leverage and assert its autonomy. In the past, similar orders to limit the sale of wheat crossline have also been scuttled, following a furor among farmers. Such changes are difficult to predict, but further changes to grain markets before the harvest are highly likely. The rapid changes now being seen are a bellwether of the depth of Syria’s economic decline.

Whole of Syria Review

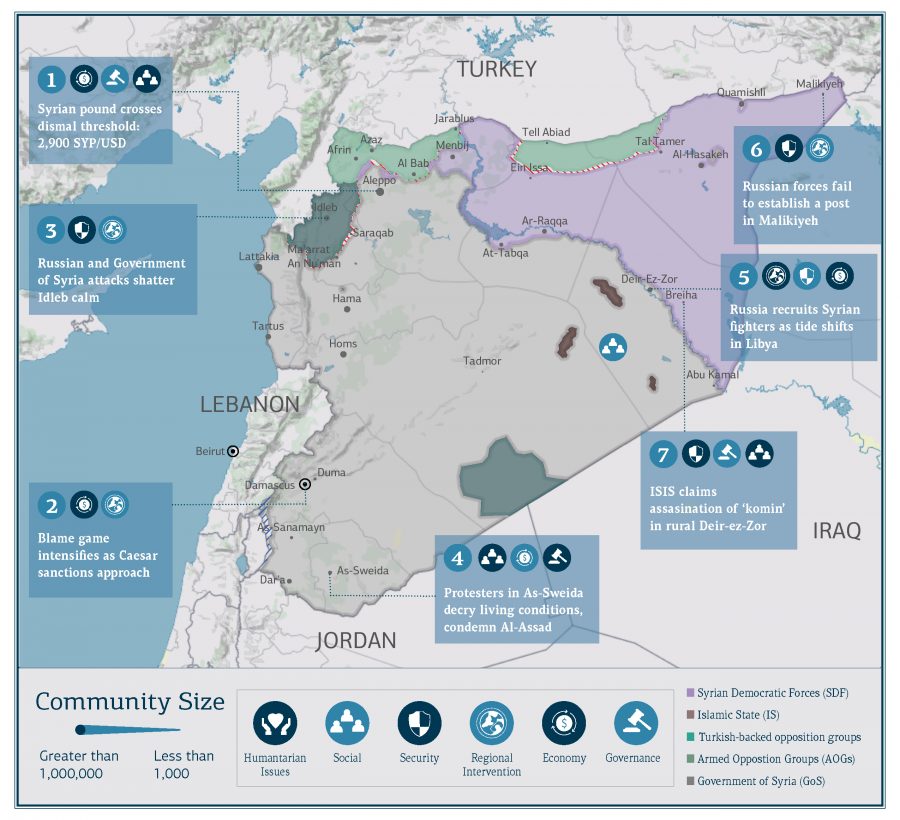

1. Syrian pound crosses dismal threshold: 2,900 SYP/USD

Aleppo, Aleppo governorate: In an alarming decline, the Syrian pound has lost 55 percent of its value in a single week. On 3 June, local media sources reported that the Syrian pound had crossed a new threshold as its parallel market value fell to 2,000 SYP/USD for the first time, triggering a rapid sell-off that sent its value plunging to 2,900 SYP/USD in some parallel markets within a matter of days. As of this writing, the actual market value of the pound remains volatile. In an apparent bid to break the currency’s freefall, the Government of Syria reportedly cracked down on money transfer offices by suspending the licenses of six informal money transfer agents (IMTA). Local media report that the Telecommunications and Postal Regulatory Agency confiscated the ledgers of the affected agents on ambiguous charges of violating the terms of operation. Central authorities will reportedly conduct a deep audit of the firms’ ledgers. Relatedly, on 3 June, local media reported that the Military Security forces on patrol in Aleppo cracked down on multiple IMTA firms, arresting multiple employees.

Syria’s economic death spiral

The Syrian economy is caught in what resembles a death spiral, and the value of the pound is rapidly diminishing. Although there is a belief that the spiking decline in the pound is a result of pessimism over the impending Caesar sanctions (see below), it is not yet clear if the pound’s decline will stabilize or continue along its worrying trajectory. In either case, there is now a realistic concern that pervasive economic deterioration will become an unavoidable element of nearly every dimension of the international Syria response and the Syria conflict itself. On the local level, Syrians are increasingly vocal over the unsustainability of living conditions due to inflation. Most notably, domestic production of medication has reportedly stalled as cost-effective production has become impossible. Local sources also indicate the pervasive nature of fears that electricity and other basic services will be sacrificed as the state’s capacity shrinks. Administratively, the Government of Syria has little ammunition to prevent currency collapse (see: Syria Update 1 June). There are credible doubts over the likelihood that a new import substitution scheme will succeed in its chief aims of halting foreign currency outflows or in meeting demand purely through domestic production (see: Syria Update 26 May). As for the international Syria response, economic deterioration has already become a barrier to procurement. Over the long term, current conditions are likely to exercise even greater influence over baseline needs throughout the country. Implementers will have to adapt, and noninflationary programmatic interventions may become more appealing as Syria’s cash economy is increasingly uncoupled from market realities. If this disintegration continues, economic collapse may well become a further driver of conflict in its own right.

2. Blame game intensifies as Caesar sanctions approach

Damascus: On 3 June, Syrian state media “strongly condemned” the impending U.S. Caesar sanctions, which are expected to enter into force in coming weeks. In an interview with the Syrian Arab News Agency, an unnamed official with the Government of Syria Foreign and Expatriates Ministry described the coercive sanctions as “hostile to the Syrian people” and an impediment to Syria’s coronavirus response. Relatedly, on 2 June, media sources reported that the Self Administration had issued an order prohibiting the transfer of dollars to areas under Government of Syria control. Reportedly, the measures are designed to insure against the potential impact of blowback over dealing with the Government, and to carry out the spirit of the sanctions law.

Render unto Caesar

In recent months, the Government of Syria has responded to mounting fiscal pressures by intensifying its efforts to construct a narrative that sanctions are responsible for the nation’s economic misery. Syrian officials have frequently made dubious appeals for sanctions relief, most recently due to the COVID-19 pandemic. However, these appeals have been undermined by the Government’s own claims of mounting a successful pandemic response. Now, the Caesar sanctions furnish a highly visible target to which they can assign further blame for economic conditions that are expected to worsen. Nonetheless, the Caesar sanctions are indeed expected to have a long-term impact on Syria, even for transactions that may qualify for humanitarian exemptions. This is because the heightened scrutiny of business transactions involving Syria will raise marginal costs, such as compliance, while it is expected that many vendors and financial institutions will refuse any such transactions out of fear of inadvertently violating restrictions or suffering potential reputational damage.

Et tu, Brute?

On a strategic level, several considerations are relevant. Sanctions targeting Syrian officials, local businessmen, and international intermediaries, as well as the third-party entities that conduct proscribed transactions with them, form a tangled knot around Syria. Such measures come both from the U.S. and the EU. In the absence of close international coordination, the functional negotiating leverage generated by sanctions will continue to be compromised, as unilateral relief does not guarantee complementary actions by other parties. The situation is even more complicated given the lack of a shared, unambiguous objective motivating the sanctions. Of note, the EU reportedly lifted restrictive measures targeting at least two named individuals after they ceased “sanctionable behavior” — reported to be participation in the Marota city project. If true, this is an important development. However, greater international cooperation and further efforts to outline realistic, narrow objectives will likely remain a key challenge to making the sanctions an instrumental component of achievable policy and political objectives.

In the near term, the impact of the Caesar sanctions will likely be reflected in the declining value of the Syrian pound. Local sources indicate that the recent slump in the currency is likely a result of pessimistic forecasts due to the onset of further sanctions. The measures enacted by the Self Administration to prevent dollar flows to Government areas are likely a prelude to further isolation of Damascus to come. The Self Administration is the most ‘dollarized’ regional economy in Syria. It will likely weather the changes best.

3. Russian and Government of Syria attacks shatter Idleb calm

Idleb governorate: On 4 June, local and media sources reported that Russian aerial attacks and Government of Syria shelling had resumed in Idleb governorate since the beginning of the month. Local sources indicate that the Government of Syria has deployed forces along the southern frontline of Jabal Al-Zawiya, in southern Idleb governorate. Across the battle lines, military reinforcements consisting primarily of Hay’at Tahrir Al-Sham (HTS) and Faylaq Al-Sham have also concentrated in the area. Additionally, Turkish forces have reportedly established three military observation points locally. Meanwhile, local sources indicated that Russian and Turkish forces have continued to conduct joint patrols along the M4 highway, although civilians have reportedly begun to displace from the area in anticipation of a Government of Syria military operation.

No green light in Idleb — yet

The resumption of limited Russian aerial attacks in Idleb marks a first in the area since the Russian-Turkish ceasefire agreement went into effect in March. Though far from signaling the collapse of the Russian-Turkish ceasefire, the return of aerial bombardment and shelling does highlight the agreement’s inherent fragility. In the case of Russia and the Government of Syria, the attacks likely serve as an assertion of dissatisfaction with the status quo, particularly Russia’s insistence that extremist groups in the area be extirpated. It is notable that attempts to rally public support for a return to the battlefield in northwest Syria have been absent, which suggests that the green light for a full-on military offensive remains off the table — for now. However, the sizable military deployments near Jabal Al-Zawiya are a worrying indicator that all parties are likely prepared to resume fighting, eventually. The odds of this recurring are raised by the risk of miscalculation, or if limit-testing provocations over-step risk tolerances. Further efforts to pressure HTS into taking up the challenge of dealing with other extremist groups are likely, as is continuing pressure by the Government of Syria and Russia.

4. Protesters in As-Sweida decry living conditions, condemn Al-Assad

Sweida, As-Sweida governorate: On 6 June, local and media sources reported that explicitly anti-Government of Syria demonstrations broke out in As-Sweida governorate. Reports differ over the scale of the protests, with estimates of crowd size ranging from dozens of participants to hundreds. As with previous public protests in the area, demonstrators chanted against Bashar Al-Assad, condemned the Russian and Iranian presence in Syria, and bewailed the state of socioeconomic deterioration in Syria. In response, on 7 June, Governor of As-Sweida Hamam Al-Dabyat stated that basic needs of the people in the governorate will be provided for and their demands will be considered.

As-Sweida remains a unique site of discontent

Against the backdrop of an unprecedented depreciation of the value of the SYP, simultaneous protests against dire socio-economic situations took place in Tafas, in Dar’a governorate, and in Domar, west of Damascus. While demonstrations are commonplace in Dar’a governorate, civilian mobilizations are less frequent in Rural Damascus and As-Sweida, where the Government of Syria has firmer grip over local security. However, the most notable aspect of the series of demonstrations is that protesters in As-Sweida directly singled-out Al-Assad. In the past, lèse-majesté has existed as a kind of red line that demonstrators have been leery of crossing. Throughout the conflict, As-Sweida has remained in a position of uneasy ambiguity vis-a-vis Damascus, and the willingness of the community to lodge public attacks against Al-Assad may indicate just how strained this relation has become, likely signaling the presence of discontent that is far deeper and far wider. Beyond the economic conditions that are now universal across Syria, over the past year, the Government of Syria has shrunk the relative autonomy of As-Sweida by moving to increase its military and security presence in a bid to contain local armed groups. At present, the Government of Syria’s response to these protests remains hard to predict. Its response will likely hinge on the position taken by the Druze religious leadership over the demonstrations. Should these demonstrations escalate and gain the support of key religious figures, the Government of Syria’s response is likely to take concrete steps to quell dissent and opposition sentiments to avoid a spillover of protests across other areas in the country.

5. Russia recruits Syrian fighters as tide shifts in Libya

Deir-ez-Zor governorate: On 31 May, local media sources reported that Russian military forces had expanded their recruitment of mercenary forces for the Libya conflict to Deir-ez-Zor. Previous reports indicate that Russia has already sought recruits in Dar’a and As-Sweida governorates. Reportedly, the recruits will undergo 45 days of training at the Deir-ez-Zor airport before being deployed to Libya, where they will be paid $1,000 for three months of service.

Two countries, one context

The open recruitment of Syrian fighters for deployment to Libya, by both Turkey and Russia, risks opening a veritable Pandora’s box (see: Syria Update 6 January). Not only will these activities further normalize the use of international mercenaries in the region (in addition to the private military contractors already deployed seeing wide use), but it will also widen the disarmament, demobilization, and reintegration challenges that exist in Syria. Additionally, it risks reproducing the same conflict dynamics that have fragmented the Syria conflict in the context of another complex crisis elsewhere in the Mediterranean. Russia and Turkey have staked opposing sides in Libya, with Russia backing the forces commanded by Khalifa Hifter against the Government of National Accord, which is supported by Turkey. Since late 2019, in response to Hifter’s advances made with the backing of Russia, Turkey has substantially increased its support to the GNA, including through direct technical assistance and the deployment of large numbers of Syrian mercenaries. In the past two months, Hifter’s forces have lost substantial territory, following a surprising set of territorial gains by the GNA. If Russia holds fast to its local partner in Libya, it will have a strong incentive to ramp-up its recruitment in Syria in response to the changing tide in the Libya conflict. Such recruitment will be pushing on an open door: Syria’s economy is in shambles, and Syrians have few livelihoods opportunities domestically. For its part, the Government of Syria is unlikely to object to the recruitment. Given the Government’s inability to provide a safety net and its incapacity to respond to the economic deterioration, recruitment of armed fighters for other combat theaters is an appealing safety valve that takes pressure off Damascus and local authorities.

6. Russian forces fail to establish a post in Malikiyeh

Malikiyeh, Al-Hasakeh: On 3 June, local and media sources reported that Russian forces attempted — and failed — to establish a fixed military presence in rural Malikiyeh. Reportedly, Russian forces tried to establish military points in two communities, Kasan and Qasr Deeb, but were met by civilian protests and demonstrations who objected to their presence. On 4 June, Russian forces reportedly resumed their attempt in Qasr Deeb, but were intercepted by U.S. forces, forcing them to withdraw from the area. Local sources indicated that U.S.-backed Syrian Democratic Forces (SDF) overtly called for civilian protests, given that these communities are generally understood as supportive of the Self Administration.

Double trouble: U.S. and Russia bang heads in the northeast

Russian forces have been steadfast in their intention to assert a firm military presence in the northeast as well as playing a key interlocutor role in service- and governance-related matters. However, the attempts to establish a military base in Malikiyeh is notable and likely stems from the area’s strategic location and importance for the Self Administration and the U.S.-led coalition. Malikiyeh is located in the vicinity of the Semalka border crossing and is known to be a base for U.S. forces. As per the terms of the Russian-Turkish agreement on northeast Syria, Government of Syria forces have maintained a symbolic presence in Malikiyeh itself, whereas Russia has reportedly planned outposts deeper in the rural inside the area, which has seemingly raised alarm bells. Despite Russia’s reported attempts to cement its standing in local communities through pragmatic outreach, this ambition could prove challenging, not least because it will bring Russia into confrontation with U.S. forces. As such, the twin presence of Russian and U.S. military forces in northeast Syria places communities in an awkward position, and tensions between Russian forces, the SDF, and U.S. forces are expected to remain in a state of flux as a result.

7. ISIS claims assasination of ‘komin’ in rural Deir-ez-Zor

Breiha, Deir-ez-Zor governorate: On 2 June, local media sources reported that ISIS claimed responsibility for the killing of Hmeid Al-Daif, head of a ‘komin’ office in Breiha, rural Deir-ez-Zor governorate. However, other media sources indicated that Daif’s assasination was a result of a personal vendetta. According to these sources, the SDF deployed reinforcements to the area to conduct raids on ISIS sleeper cells.

An ambiguous omen

It is difficult to assess whether the assasination was carried out by ISIS or as an act of personal vengeance or localized violence. In either event, the threat of isolated, limited activities by ISIS-linked actors remains salient in SDF-controlled areas, particularly in rural Deir-ez-Zor. This is particularly true given the fragility of the Self Administration’s presence in many rural communities that are under its nominal control. Komin agents play a particularly important role in local administrative affairs, and they act as the interface between remote bureaucratic structures and local communities. This adds an additional layer of political concern to the killing, but it is also possible that the event was driven wholly by interpersonal grievances. Either possibility casts light on the tensions that exist in many communities of eastern Syria.

Key Readings

The Open Source Annex highlights key media reports, research, and primary documents that are not examined in the Syria Update. For a continuously updated collection of such records, searchable by geography, theme, and conflict actor, and curated to meet the needs of decision-makers, please see COAR’s comprehensive online search platform, Alexandrina, at the link below.

Note: These records are solely the responsibility of their creators. COAR does not necessarily endorse — or confirm — the viewpoints expressed by these sources.

A new Gaza: Turkey’s border policy in northern Syria

What Does It Say? The author argues for targeted EU stabilization support to areas of northern Syria that are under Turkey’s control.

Reading Between the Lines: Walking away from northern Syria risks creating another Gaza-like enclave. Among the challenges to creating a coherent approach to targeted engagement in the area — and Syria more generally — is the lack of a unified position within Europe itself.

Source: European Council on Foreign Relations

Language: English

Date: 28 May 2020

Syria: Sanctions against the regime extended by one year

What Does It Say? The EU has extended sanctions on Syria until 1 June 2021, stating the purpose of the measures is to combat the repression of the civilian population.

Reading Between the Lines: The EU’s restrictive measures in Syria face a multitude of practical challenges, including the existence of multiple layers of U.S. sanctions as well as the absence of a unified policy and political objective.

Source: European Council

Language: English

Date: 28 May 2020

The Gendered Journey of Return: The Case of Syrian Women in Lebanon

What Does It Say? The paper offers a window onto the specific difficulties faced by Syrian women refugees in Lebanon and their considerations when contemplating a return to Syria.

Reading Between the Lines: Split returns have been common in Syria, as many men remain wanted for military service or face security restrictions, thus complicating protect and livelihoods concerns for women returnees who have be forced to take the journey alone.

Source: Friedrich Ebert Stiftung

Language: Arabic

Date: 28 May 2020

Russia’s involvement in the Middle East: Building sandcastles and ignoring the streets

What Does It Say? The author contends that since Russia’s direct military intervention in the Syria conflict in 2015, a clear endgame remains elusive.

Reading Between the Lines: The paper misses the forest for the trees: Despite ambiguity over Russia’s long-term intentions in Syria, many important realities are clear: its influence in Damascus is paramount. Russia continues to be the most important international voice speaking for the Government of Syria. The success of its Syria intervention suggests that a broader ambition for regional influence and access to the Mediterranean Sea will be paid out.

Source: Middle East Institute

Language: English

Date: 1 June 2020

Syria’s Reconstruction Between Discriminatory Implementation and Circumscribed Resistance

What Does It Say? The paper examines Marota city as a template for the use of Decree No. 66 to allow the Government of Syria to earmark reconstruction areas to consolidate control.

Reading Between the Lines: Marota city remains a flashpoint issue of foremost interest among the international response, yet it is likely indicative of a pattern that may play out elsewhere. Reconstruction as currently understood through the lens of Marota will likely lead to consolidated control and stifled dissent.

Source: Carnegie

Language: English

Date: 15 May 2020

Where regime military reinforcements in Dar’a are concentrated

What Does It Say? The map illustrates where the Government of Syria has deployed military reinforcements in across Dar’a.

Reading Between the Lines: The majority of the reinforcements have been deployed to areas formerly held by the opposition, in a likely attempt to contain latent anti-Government sentiment and contain those areas through forced submission.

Source: Jusoor

Language: Arabic

Date: 2 June 2020

A model city in Al Lajat under construction … What is Russia’s relationship with it?

What Does It Say? A model city is being planned in Al Lajat with the purpose of providing residence to Christian, Druze, and Bedouin families that have been displaced or affected by the fonclit.

Reading Between the Lines: While the outward goal of the city is to establish that peaceful coexistence is possible, sectarian questions are not the chief driver of conflict in most of Syria. The real source of dissent will not be addressed by such a project.

Source: The Levant News

Language: Arabic

Date: 3 June 2020

What Does It Say? In 2019, Syria imported an estimated 4.23 billion USD worth of products, with China and Turkey serving as its largest suppliers.

Reading Between the Lines: This data is a reminder that China and Turkey both remain important commercial partners to Syria, irrespective of their differing political positions.

Source: Commercial SY

Language: Arabic

Date: No Date

The Wartime and Post-Conflict Syria project (WPCS) is funded by the European Union and implemented through a partnership between the European University Institute (Middle East Directions Programme) and the Center for Operational Analysis and Research (COAR). WPCS will provide operational and strategic analysis to policymakers and programmers concerning prospects, challenges, trends, and policy options with respect to a conflict and post-conflict Syria. WPCS also aims to stimulate new approaches and policy responses to the Syrian conflict through a regular dialogue between researchers, policymakers and donors, and implementers, as well as to build a new network of Syrian researchers that will contribute to research informing international policy and practice related to their country.