Syria Update

09 May to 15 May, 2019

The Syria Update is divided into two sections. The first section provides an in-depth analysis of key issues and dynamics related to wartime and post-conflict Syria. The second section provides a comprehensive whole of Syria review, detailing events and incidents, and analysis of their respective significance.

The following is a brief synopsis of the in-depth analysis section this week:

On May 12, four oil tankers were reportedly sabotaged in the vicinity of Fujairah, in the UAE. No actor has claimed responsibility, and investigations are still ongoing, but unnamed U.S. officials have stated to U.S. media that early indications suggest Iran is responsible. Ultimately, Iran’s culpability is irrelevant; recent U.S. actions have already made conflict with Iran an increasingly realistic possibility. Renewed sanctions are devastating to the Iranian economy, and the U.S. has deployed numerous new military assets to the Middle East for the express purpose of countering Iran. More troubling is that Iran has few options to de-escalate the situation; it is almost impossible for Iran to meet U.S. demands, and the country’s leaders are now forced to choose between aggressively challenging the U.S. and its allies in the region, or the passive acceptance of a new round of sanctions and hope that the U.S. leadership changes in 2020. Moreover, Saudi Arabia, the UAE, and Israel (as well as hardline political blocs in both the U.S. and Iran) appear to be willing to escalate tensions, increasing the risk that an unintended conflict metastasizes beyond the control of any individual actor. Naturally, the potential for a major U.S.-Iran confrontation will have severe repercussions for both Syria and the entire region.

The following is a brief synopsis of the Whole of Syria Review:

- Government of Syria forces continued to advance in northwestern Syria, and have now secured much of the Sahel Ghab; these forces are likely to advance on Khan Sheikun, but are not expected to seek the capture of all of the opposition-controlled northwest.

- An Iranian oil tanker arrived in Banyas and delivered an estimated 1,000,000 barrels of fuel; while the fuel delivery will certainly contribute to alleviating Syria’s ongoing fuel crisis, it will have only a short-term impact.

- Tensions continued between Arab tribal communities and the SDF in Deir-ez-Zor; many such tensions have their origins in fuel trade arrangements between the Government of Syria and the SDF, crackdowns on fuel smuggling, and the fact that profit sharing formats have not been distributed to the satisfaction of communities in Deir-ez-Zor.

- Local unrest and ongoing security incidents remain a constant factor in southern Syria; considering the Government of Syria’s focus on northwestern Syria, it is unlikely these tensions will be addressed in the near term.

- An IED was detonated in Damascus, the fourth this year. While Damascus remains stable and highly securitized, continued security incidents in the capital are expected to remain an enduring risk.

- Chinese President Xi Jinping indicated that China may be willing to participate in Syria’s reconstruction as part of the Belt and Road infrastructure initiative. Chinese involvement in Syria’s reconstruction, likely led by private companies, will have a massive impact on Russian and Iranian reconstruction efforts.

- The UAE Red Crescent delivered humanitarian aid in Damascus, marking the first UAE humanitarian aid delivery in Government of Syria-controlled areas. The UAE’s rapprochement with the Government of Syria continues, though these efforts may be complicated by ongoing Gulf state tensions with Iran.

- The SDF is reportedly exploring changing its existing conscription policies. Though reform intends to address the unpopularity of current policy, local tension is nevertheless expected to increase given the cost of avoiding conscription is prohibitively high for impoverished individuals to afford exemption.

U.S.-Iran Confrontation

In Depth Analysis

On May 12, four oil tankers were reportedly sabotaged in the vicinity of Fujairah, in the UAE. Saudi Arabia has claimed two of the tankers, a Norwegian company has claimed one, and one was reportedly flagged in the UAE. Though no actor has claimed responsibility, and investigations are still ongoing, unnamed U.S. officials have stated to U.S. media that early indications suggest that Iran is responsible. This comes only days after the U.S. Maritime Administration issued an advisory warning that “there is an increased possibility that Iran and/or its regional proxies could take action against U.S. and partner interests, including oil production infrastructure…Iran or its proxies could respond by targeting commercial vessels, including oil tankers, or U.S. military vessels in the Red Sea, Bab-el-Mandeb Strait, or the Persian Gulf.”

Iran’s responsibility is certainly debatable. Indeed, numerous analysts have questioned the timing and impact of the incident, and there is speculation as to whether the incident was a ‘false flag’ attack undertaken in an attempt to increase tensions between the U.S. and Iran. This, ultimately, is irrelevant however; recent U.S. actions have already made conflict with Iran an increasingly realistic possibility. On May 2, the U.S. refused to renew all existing waivers for countries still importing Iranian oil which, although has not entirely stopped Iranian oil exports, has nearly destroyed the Iranian economy in tandem with the new sanctions. Moreover, the U.S. has deployed the USS Abraham Lincoln Carrier Strike Group, has reinforced the U.S. 5th Fleet based in Qatar, and has deployed B-52s from the 20th Bomber Squadron (which are already conducting their first ‘deterrence’ missions). U.S. media has furthermore reported that acting U.S. Secretary of Defence Patrick Shanahan presented an updated military plan on May 9 which envisioned the deployment of up to 120,000 U.S. military personnel to the Middle East in the event that Iran “attacks American forces or accelerates work on nuclear weapons”. Of note, the U.S. deployed approximately 177,000 troops to the Middle East prior to the Iraq invasion.

Equally concerning is that is that it will be extremely difficult – if not impossible – for Iran to de-escalate the situation. In order to remove the sanctions, the U.S. is demanding numerous terms that Iran cannot abide, to include a complete withdrawal from Syria and the withdrawal of support for Hezbollah. Realistically, Iran therefore has only two options: aggressively challenge the U.S. and its allies in the region in the hope this will force the U.S. to reconsider its regional policy, or passively accept the destructive impact of the new sanctions and hope for a change of U.S. leadership in 2020. The latter is no guarantee that conflict will be avoided however; even if Iran chooses this more passive policy of de-escalation, the current climate means that even a small incident could grow into a much larger conflict. The fact that Saudi Arabia, the UAE, and Israel (as well as hardline political blocs in both the U.S. and Iran) all appear to be willing to escalate the situation increases the risk that an unintended conflict metastasizes beyond the control of any individual actor.

The impact of a major U.S.-Iran confrontation would be so large it is difficult to conceptualize, both in Syria, and in the region itself. Even if an all out war between the U.S. and Iran is avoided, the risk of instability and conflict in areas where Iranian-backed groups are in close proximity to the U.S. and its allies is extreme. This would certainly include Deir-ez-Zor and Abukamal in northeastern Syria, where Iranian-backed groups are within kilometers of U.S. military forces, and southern Syria, where Iranian-backed groups and Hezbollah are located in the vicinity of the Israeli border. Moreover, both the Syrian and Iraqi economies and military establishments are closely linked to Iran, whilst Lebanon risks being drawn into open conflict with Israel due to Hezbollah’s role in the Lebanese government. The latter would necessarily have an impact in Syria given the number of Syrian refugees in Lebanon, and the fact that much of the Syria response is based in Beirut. Conflict between the U.S. and Iran is by no means unavoidable, cooler heads may yet prevail, and indeed, U.S. President Trump appears to be opposed to U.S. military intervention as a general policy. However, a quote attributed to Barbara Tuchman (the author of The Guns of August, the seminal history of the start of WWI) comes to mind: “War is the unfolding of miscalculations.”

Whole of Syria Review

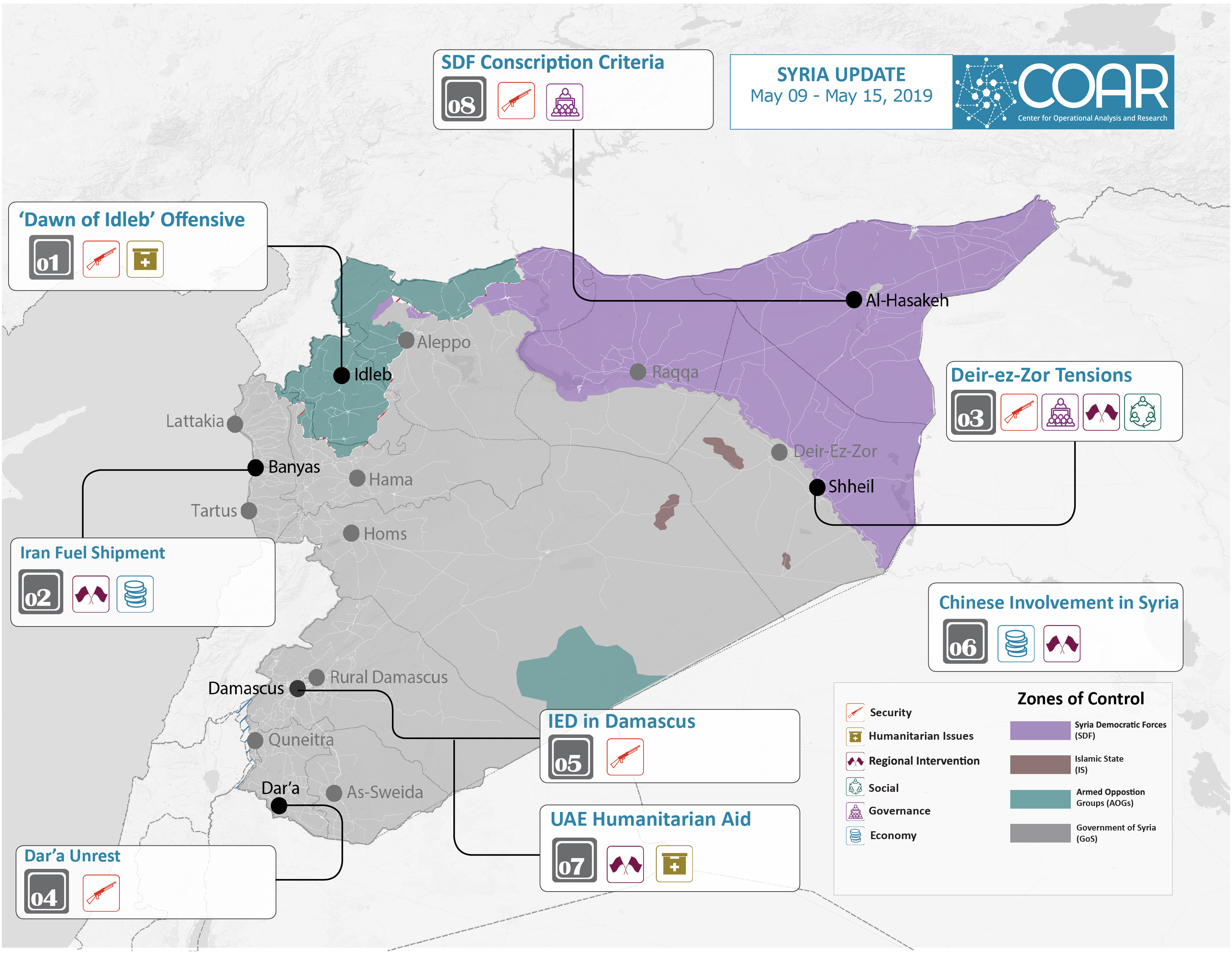

1. ‘Dawn of Idleb’ Offensive

Hama Governorate, Northwestern Syria: Government of Syria forces continue to advance in northwestern Hama governorate. Since taking Qalaat Al-Madiq on May 9, Government of Syria forces captured Al-Hawash, Al-Tawbah, Hardana, and Sheikh Idris on May 13, and Kafr Nabutha on May 14, all under cover of strong Syrian and Russian air support. Meanwhile, armed opposition groups, primarily Hay’at Tahrir Al-Sham, have reportedly repelled Government of Syria attempts to infiltrate frontlines in Latakia governorate, killing as many as 30 Government of Syria combatants in the process. Relatedly, on May 14, Turkish President Erdogan, reportedly expressed concern over the military operations in northwestern Syria in a phone call with Russian President Putin.

Analysis: The military campaign in northwestern Syria is expected to adhere to broader Russian-Turkish agreements pertaining to northern Syria, likely that the Government of Syria will not go so far as to seek the capture of all of opposition controlled northwestern Syria. This means that Government of Syria forces are therefore expected to advance into and secure all of northern rural Hama, to include Khan Shiekun. Jisr Ash-Shughur, in southwestern Idleb governorate, may also be targeted as part of this offensive. Meanwhile, the Government of Turkey and the Turkish-backed National Army are expected to continue their own offensive on Tal Rifaat, which was announced on the same day as the Government of Syria’s offensive on northwestern Syria. As noted in last week’s Syria Update however, it is unclear when the National Army’s offensive will commence in earnest. Of note, recent official statements from Turkish officials indicate that the final status of control in northwestern Syria has yet to be finalized, and that discussions with Russian counterparts are ongoing.

2. Iran Fuel Shipment

Banyas, Syria: In the first week of May, several sources tracked an Iranian oil tanker to the Syrian port of Banyas. The tanker reportedly delivered 1 million barrels of crude, which is believed to be the first such Iranian delivery to Syria in 2019. Notably, current fuel production levels in Syria, to include SDF-controlled fields in the northeast, is estimated at 24,000 barrels per day, which is some 325,000 barrels down on pre-war production. Domestic production falls far short of current demand, which local sources estimate at approximately 136,000 barrels per day.

Analysis: At current rates of consumption, the May import of Iranian crude is only likely to satisfy local demand for a maximum of two weeks. In reality, this period will be much shorter given significant amounts are likely to be stockpiled by opportunistic traders seeking to manipulate fuel prices, meaning much will be unavailable for private consumption. As a result, Syria’s fuel crisis will persist, particularly given prospects for sustained Iranian imports are bleak in the context of heightened U.S. sanctions. An increase in Syria’s national production is also currently improbable in the near to medium term, largely due to the impact of international sanctions, a related lack of capital, and the attention required to rehabilitate Syria’s extensively damaged oil infrastructure.

3. Deir-ez-Zor Tensions

Shheil, Deir-ez-Zor Governorate, Syria: Tensions between local communities and the SDF in Deir-ez-Zor governorate have persisted. After clashes lasting several hours, several media sources report that the SDF conducted a raid in Shheil with support from U.S.-led coalition forces which resulted in at least 6 deaths and two detentions. The SDF claimed that the detainees were secretly supporting ISIS. Notably, the SDF raided Shheil in early April 2019 as part of a general crackdown on fuel smugglers across Deir-ez-Zor. Additionally, media sources report that U.S.-led coalition representatives continue to mediate a potential fuel profit sharing agreement between Arab tribes in Deir-ez-Zor and the SDF. These sources claim the deal pertains to the Tank and Seijan oil fields. On May 13 however, members of the Ageidat tribe also reportedly held a meeting in Shheil, at which they condemned the SDF’s role in monopolizing local hydrocarbon revenues and “demanded their economic rights.”

Analysis: While there is no evidence linking the SDF’s recent raid on Shheil and fuel smuggling, it indicates increasing tensions between Arab tribal communities in Deir-ez-Zor governorate and the SDF. Indeed, the frequency of confrontations in Deir-ez-Zor demonstrate the SDF’s continued failure to secure the support of Arab communities in the governorate. The well-publicized fuel deal under discussion is likely an attempt to reconcile the SDF with local tribal figures, but its impact will likely be questionable. The economic prospects of Deir-ez-Zor’s predominantly Arab tribal communities will likely remain bleak, and the deal with do little to ensure the representation of Arab tribal figures in SDF governance structures. SDF efforts to maximize oil revenues will also continue to fuel local tension. While the SDF appears compliant with U.S. efforts to curb the cross-line fuel trade with the Government of Syria, it is simultaneously attempting to monopolize the profits from this trade through agreements with Government of Syria business elites, such as Hossam Qaterji. This policy manifests itself on the ground in the form of crackdowns on (predominantly Arab tribal) fuel smugglers, whilst avoiding fully sharing the profits generated from broader fuel trading agreements with entities such as the Qaterji Group.

4. Dar’a Unrest

Dar’a governorate, southern Syria: As of May 14, security incidents in western Dar’a governorate appear to have escalated. Local sources indicate that flyers have been distributed in Da’el, rural Dar’a governorate, calling for solidarity with Idleb and “continued opposition to the Al-Assad regime.” Flyers condemning Hezbollah’s presence were also reported. Meanwhile, two VBIED attacks have taken place in Dar’a governorate this week. The first took place on May 5, on the road between Bisr Elharir and Izra’, resulting in the death of six Government of Syria 5th Division combatants. The second took place in Dar’a city on May 6, and killed a former commander of the Dar’a Free Police, Ahmad Rodwan Falouji, and a former member of Dar’a local council, Mazid Ibrahim Al-Abazid.

Analysis: Security incidents in Dar’a remain concentrated in formerly opposition-controlled parts of Dar’a, such as southern Dar’a city and western and eastern rural Dar’a governorate. As frequently noted, these incidents are a result of the failure of reconciliation to deliver satisfactory solutions to the most pressing concerns of residents in formerly opposition-held areas, specifically those pertaining to conscription and the presence of Government of Syria forces. Tensions between the population and the Government of Syria have been exacerbated by continued conflict between a variety of nominally pro-Government of Syria military and security branches, and are expected to continue without serious redress in the near term given the current preoccupation of the Government of Syria and its allies with the northwest. Southern Syria is therefore expected to remain deeply unstable for the foreseeable future.

5. IED in Damascus

Damascus city, Syria: On May 11, media sources reported that a VBIED detonated in the vicinity of Zahera and Tadamon neighborhoods in Damascus city. These sources state the explosion resulted in 11 deaths. The attack has yet to be claimed. Notably, this VBIED is the fourth IED to target Damascus city this year. Prior to this incide, the most recent IED was detonated in the Nahr A’eisha neighborhood, on April 24.

Analysis: Despite the general stability of Damascus city, especially since the Government of Syria took control on Eastern Ghouta and southern Damascus in mid-2018, security incidents nevertheless remain likely. Competition among various Government of Syria forces and divisions, the continued presence of sleeper cells, and challenging economic conditions in the city and its vicinity each represent real and potential sources of instability. Syria remains profoundly unstable, and occasional asymmetric attacks from a variety of sources can therefore be expected in the capital.

6. Chinese Involvement in Syria

Beijing, China: During the Belt and Road Initiative (BRI) Forum, held in Beijing on April 26 and 27, Chinese President Xi Jinping stated that China aims to participate in the reconstruction of Syria. Xi highlighted the natural partnership between both countries which he stated was rooted in the ancient silk road, and added that communications between both governments are gradually increasing. In this regard, on May 13, Government of Syria media outlets reported on a meeting between Russian Foreign Minister, Sergey Lavrov, with his Chinese counterpart, Wang Yi, in Sochi. Both officials reportedly reiterated their government’s support for UNSC 2254 as means to restore nation-wide stability and pave the way for the reconstruction.

Analysis: China has had a general policy of non-interference in Syria. Despite having vetoed resolutions in the UNSC, China’s stance on the war has been generally limited to assertions of sovereignty and Syria’s territorial integrity. However, speculation on Chinese participation in Syria’s reconstruction and post war development has increased following the Chinese-Arab cooperation forum held in July 2018, at which China announced a loan package of $23 billion for Arab countries, including Syria. Similar to other countries on the Mediterranian’s eastern periphery, Syria represents a key node in the global Chinese Belt and Road infrastructure initiative. This is especially true considering the fact that the Government of China now is already an important partner for both of Syria’s main allies, Russia and Iran. Indeed, it is increasingly likely that Chinese private companies will take part in Syria’s reconstruction, and will act not only as vehicles for post-conflict Chinese-Syrian collaboration, but also as effective implementers of Syria’s economic agreements with its allies.

7. UAE Humanitarian Aid

Damascus City, Syria: On May 12, media reported that the UAE Red Crescent had distributed humanitarian aid in Marjeh, in Damascus city. The project, entitled ‘Iftar’, reportedly distributed food baskets to an unknown number of people. This marks the first time the UAE has provided aid in Government of Syria-controlled areas. Of note, the UAE reopened its embassy in Damascus in December 2018.

Analysis: The UAE’s rapprochement with the Government of Syria is likely concerned with securing a role in Syria’s reconstruction. This, in turn, is expected to influence the outlook of other Gulf states, such as Saudi Arabia. That said, the UAE’s move into Syria could be slowed by heightened tensions between Gulf countries and Iran over maritime transit in the Strait of Hormuz.

8. SDF Conscription Criteria

Al-Hasakeh Governorate, Northeastern Syria: On May 12, several media and local sources reported that the Kurdish Self Administration (KSA) had proposed to amend criteria pertaining to military conscription. The amendments reportedly stipulate that individuals can avoid conscription by paying $6,000, that the maximum age for conscripts will be increased from 30 to 33, and that students and males in one male families will be exempted. The amendments also specify that the new policy will apply to foreigners in possession of residency permits in SDF-controlled areas in addition to Syrian citizens. To postpone service, non-Syrians holding residency permits, with the exception of Turkish and Iraqi citizens, may be required to pay a monthly fee of $400.

Analysis: Despite the amendments, the KSA’s conscription policies will most likely be poorly received. Indeed, taxation and conscription have been a point of contention between the KSA and local communities, often manifesting in public demonstrations and devolving into direct confrontations. Though new exemptions present some conscription-aged males to avoid military service (as well as generate revenue for the KSA), many individuals will be unable to pay $6000 for the privilege. Even those able to pay may be unwilling to do so considering the long-term viability of the KSA is uncertain, and may mean that they will be subject to subsequent exemption fees requested by the Government of Syria.

The Wartime and Post-Conflict Syria project (WPCS) is funded by the European Union and implemented through a partnership between the European University Institute (Middle East Directions Programme) and the Center for Operational Analysis and Research (COAR). WPCS will provide operational and strategic analysis to policymakers and programmers concerning prospects, challenges, trends, and policy options with respect to a conflict and post-conflict Syria. WPCS also aims to stimulate new approaches and policy responses to the Syrian conflict through a regular dialogue between researchers, policymakers and donors, and implementers, as well as to build a new network of Syrian researchers that will contribute to research informing international policy and practice related to their country.

The content compiled and presented by COAR is by no means exhaustive and does not reflect COAR’s formal position, political or otherwise, on the aforementioned topics. The information, assessments, and analysis provided by COAR are only to inform humanitarian and development programs and policy. While this publication was produced with the financial support of the European Union, its contents are the sole responsibility of COAR Global LTD, and do not necessarily reflect the views of the European Union.