Syria Update

20 June to 29 June, 2019

The Syria Update is divided into two sections. The first section provides an in-depth analysis of key issues and dynamics related to wartime and post-conflict Syria. The second section provides a comprehensive whole of Syria review, detailing events and incidents, and analysis of their respective significance.

The following is a brief synopsis of the in-depth analysis section this week:

On June 19, the unofficial exchange rate of the Syrian Lira reached 609 SYP/USD, its lowest rate in three years; the ‘official’ exchange rate of the Syrian Central Bank remains unchanged, at 434 SYP/USD. While the Syrian Lira has consistently depreciated since the start of the Syrian conflict, it remained relatively stable between 460-500 for nearly two years; however, beginning in January 2019, it has steadily declined to its present rate. The Governor of the Syrian Central Bank, Hazem Qarfoul, cited “speculation” and international sanctions as the primary reason for the Lira’s decline. Qarfoul is not entirely incorrect; sanctions have had a serious impact on the Syrian economy, and currency speculation is a real concern. That said, the reasons for the Liras decline are multifaceted and not easily solved. Increased sanctions on Iran are a major contributing factor, as Iran has been compelled to withdraw important lines of credit to Syria; the dollar itself is strong relative to other currencies globally; and several other factors contribute to increased pressure on the Lira. Ultimately however, the downward pressure on the Lira stems from the fact that the Syrian economy is in shambles, and shows few signs of recovery. The continued depreciation of the Lira will have multiple immediate impacts, to include on individual Syrian’s purchasing power, and the cost of imports. However, perhaps the largest impact of the Lira depreciation is uncertainty: ultimately, the ‘natural’ exchange rate for the Lira is unclear, and should the Lira continue to depreciate at a more rapid rate Syria could enter a hyperinflationary cycle which will be difficult or impossible to mitigate.

The following is a brief synopsis of the Whole of Syria Review:

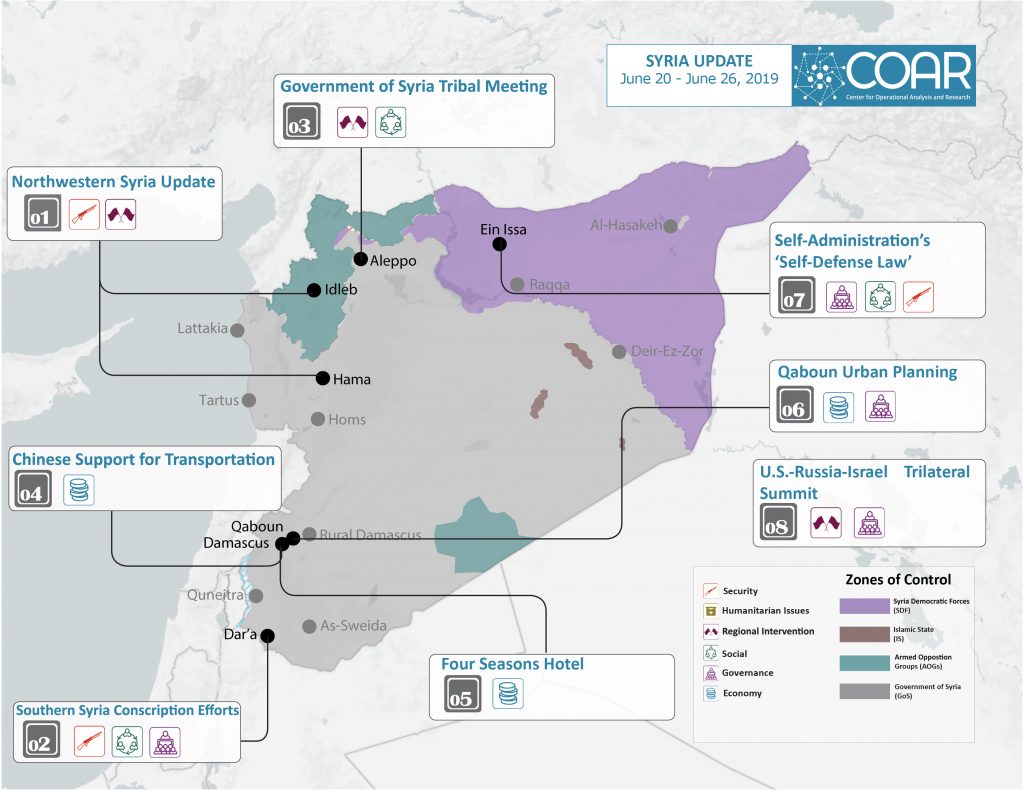

- Frontlines remain unchanged in northwestern Syria in spite of continuous shelling and conflict; despite Government of Syria reinforcements, it is likely that only an agreement between Russia and Turkey will bring an end to the current offensive.

- Government of Syria conscription efforts intensify in southern Syria as the end of the reconciliation “grace period” looms; should the Government of Syria fail to extend the grace period or acquiesce to local demands, southern Syria will likely witness further instability.

- The Government of Syria held another meeting with tribal leaders from northeastern Syria, concurrent with recent U.S. and Saudi Arabian efforts to engage northeastern Syria’s tribes. Ultimately, engagement with these tribes will shape the outcome of any negotiations between the Kurdish Self-Administration and the Government of Syria.

- The Chinese government offered the Government of Syria 100 new public transportation buses. China will likely take an increasingly large role in Syria’s reconstruction, primarily in transportation infrastructure as part of the “Belt and Road” initiative.

- The Four Seasons hotel chain terminated its management of its Syrian branch, likely due to the recent sanctions on Syrian businessman Samer Foz. There are continued concerns that Al-Baraka Bank will withdraw its management of its Syrian branch, which may have an impact on the Damascus-based response.

- The urban plan for the Qaboun neighborhood of Damascus city was finalized; Qaboun will be re-zoned. Ultimately, this will likely lead to the tabula rasa redevelopment of Qaboun, causing significant HLP concerns.

- The Self-Administration announced a new conscription policy. The policy will be applied differently in different localities, likely leading to new communal tensions; the law will exacerbate existing tensions with the Government of Syria.

- The U.S., Israel, and Russia held a high-level meeting in Jerusalem on the role of Iran in Syria; even if the U.S. and Israel were able to persuade Russia to reduce Iran’s influence in Syria, it is unlikely that Russia would be capable of doing so.

Syrian Lira Depreciation

In Depth Analysis

On June 19, the unofficial exchange rate of the Syrian lira reached SYP 609/USD. This is the lowest exchange rate recorded for the Syrian lira in three years; the last time the exchange rate hit 600 was in May 2016; that low lasted for a period of several days before the lira rapidly strengthened. Notably, the “official” Syrian Central Bank exchange rate for the Syrian lira remains unchanged, at SYP 434/USD. On June 19, in an attempt to address the spike in the exchange rate, Syrian Central Bank Governor Hazem Qarfoul went on Syrian television twice in 24 hours to explain the position of the Central Bank. Qarfoul defended the official exchange rate, arguing that the recent spike could largely be attributed to “speculation.” He also argued that the rise in the unofficial exchange rate came as part of a “systematic campaign” to weaken the Syrian economy, citing the U.S. Caesar sanctions. He also claimed that “the rise of the dollar is imaginary and has no economic justification on the ground.” Qarfoul insisted that the Central Bank was unlikely to change its official rate, stating that it “follows a conservative [monetary] policy, and [only] speaks when there is a new policy or decision.”

For several years (between late 2016 and late 2018), the lira did manage to maintain a fairly consistent unofficial exchange rate, in the vicinity of SYP 460–500/USD. However, since January 2019, the Syrian lira has steadily depreciated to its current price of ~SYP 600/USD. Thus, while the lira’s depreciation to SYP 600/USD did not happen overnight, it is still a fairly rapid decline and has sparked considerable fears that the lira will continue to depreciate. These fears are not unfounded, largely due to the fact that the causes of the lira’s depreciation are multifaceted and almost impossible to solve in the near-term.

Qarfoul is not wrong when he states that a major contributing factor to the rise in the unofficial exchange rate is international sanctions on Syria, especially on the Syrian banking sector. However, equally damaging to Syria’s economy are renewed U.S. sanctions on Iran, which have become much more intense over the past six months and have at least partially forced Iran to reduce its financial commitments in Syria. Iran provided, and expanded, numerous credit lines to Syria in the earlier stages of the conflict. Several of these credit lines have reportedly been reduced or withdrawn—the most important was a several billion dollar credit line for Iranian fuel purchases, which was suspended in October 2018 (seriously contributing to Syria’s ongoing fuel crisis).

There are other factors for the rising exchange rate that are beyond Syria’s control—for instance, the dollar itself is currently strong relative to other currencies, which naturally impacts the SYP/USD exchange rate. A recent Syrian “anti-corruption” initiative has also reportedly increased pressure on the lira, as state employees now face increased scrutiny of their finances by security officials. The Government of Syria’s inability to make significant military progress in northwestern Syria is also reportedly a contributing factor; there is historical precedent for the depreciation of the lira when the Syrian military faces difficulties.

However, the depreciation of the Syrian lira must ultimately be attributed to the dire state of the Syrian economy as a whole. Much of the country is still in shambles, funds for reconstruction are not likely to be forthcoming in the near-term, and fuel will remain largely unavailable or expensive for the foreseeable future. The underlying structural failures of the Syrian economy are likely to cause the Syrian lira to continue to depreciate, with no clear end in sight.

The continued depreciation of the lira will have multiple immediate impacts. First and foremost, the depreciating lira will naturally impact individual Syrians’ purchasing power. This is especially true for the large majority of Syrian salaried workers (for instance, state employees) who are paid a set salary in Syrian lira; effectively, salaried employees took a ~25 percent pay cut in real terms between January and June 2019. The depreciated lira will also increase import costs; this is of critical importance, as Syria is now heavily reliant on imports of numerous goods, including fuel, food, and raw materials. However, perhaps the largest impact of the lira depreciation is uncertainty: it is not clear what the “natural” exchange rate for the lira actually is. As previously noted, Qarfoul cites “speculation” as a major concern; should the Lira continue to depreciate rapidly, Syria could enter a hyperinflationary cycle, which will be difficult if not impossible to mitigate.

Whole of Syria Review

1. Northwestern Syria Update

Idleb, Hama, and Aleppo governorates, Syria: Throughout the reporting period, Government of Syria forces continued their attempts to advance in northern and northwestern rural Hama Governorate; notably, no actor has achieved any significant advances in the area. Media sources indicated that clashes currently center on the frontlines of Tal Milh and Al-Jbien, in Hama Governorate, which remain under the control of armed opposition groups. On June 24, several media sources reported on further Turkish military reinforcements to Hama Governorate; one source indicated that a total of 20 Turkish vehicles were deployed to the Shir Mghar observation point, in western Hama. Other media sources reported on increasing Russian dissatisfaction with the course of the military operations and with the failure of Government of Syria forces to achieve any territorial advances. To that end, the Government of Syria has reportedly deployed new commanders and generals to the frontlines in northwestern Syria. These new arrivals include the head of Syrian Air Intelligence, Jamil Al-Hasan. Government of Syria and Russia airstrikes have continued to relentlessly target numerous communities throughout northwestern Syria.

Analysis: Government of Syria forces have reportedly suffered serious manpower losses on northern Hama frontlines, and have been unable to bring about any major changes in the zones of control on the frontlines throughout the northwest. Indeed, the Turkish government has made it clear that it is unwilling to hand over the control of territory in northwestern Syria to the Government of Syria; to that end, Turkey has reportedly empowered and supported certain armed opposition groups defending frontlines in northwestern Syria. Despite ongoing military setbacks, the Government of Syria has not shown any indication that it will halt the offensive. The conflict in the northwest will likely continue for the foreseeable future, although no territorial changes are expected. Ultimately, the conflict is only likely to cease due to Russian and Turkish negotiations, which appear to be effectively frozen.

2. Southern Syria Conscription Efforts

Dar’a Governorate, Syria: On June 21, local sources reported that civilians in Dar’a Al-Balad held a demonstration calling on the Government of Syria to release detainees and remove checkpoints at the periphery of the city; the government had established several new checkpoints in the preceding two weeks. On the same day, the Government of Syria State Security Branch in Inkhil circulated a new list of those wanted for military service. Notably, the list included the names of reconciled former combatants in Shabab Al-Sunna, who are already enrolled in the Government of Syria’s 5th Corps, as well as several deceased individuals. The Government of Syria’s renewed efforts to conscripts individuals in Dar’a align with the June 24 conclusion of the Dar’a reconciliation agreement “grace period.” Relatedly, on June 23, local sources reported that Government of Syria forces had increased their harassment of those crossing through throughout checkpoints in Dar’a Governorate; soldiers at checkpoints have reportedly been confiscating civilian identification documents and forcing civilians to sign a pledge to either refer to a military conscription office within seven days or be considered defectors. Additionally, on June 23, media sources reported that a reconciled armed opposition commander, Adham Krad, had released a statement in which he reiterated his refusal to take part in any military offensive in Idleb. Media reports indicated that reconciled representatives from Dar’a have convened a meeting with Government of Syria officials in Damascus to study the possibility of extending the reconciliation “grace period” for another six months. Meanwhile, security incidents continued throughout southern Syria; media and local sources reported on at least three attacks on Government of Syria checkpoints—in Da’el, Karak, and Deir Eladas— over the past week.

Analysis: With the formal end of the post-reconciliation “grace period,” the Government of Syria is likely to now drastically increase its attempts to conscript eligible military-age males throughout southern Syria. Naturally, this will be deeply unpopular and highly destabilizing. Conscription is almost universally unpopular across Syria; however, this is especially true in western rural Dar’a, both because the Government of Syria is deeply unpopular and because many individuals fear deployment outside of southern Syria, to frontlines in Idleb and northern Hama. The degree to which the Government of Syria is willing to accomodate community demands is, therefore, of utmost importance. Any attempt to fully enforce existing conscription policies is likely to result in further destabilization. However, if local Government of Syria governance and security officials acquiesce to some element of local demands—perhaps ensuring that conscripts remain deployed in the vicinity of their home communities—local discontent may be partially mitigated. Ultimately, much will depend on the actual implementation of conscription, especially given that Government of Syria security services in southern Syria are engaged in serious (often violent) competition with each other, and are unlikely to follow any unified policy.

3. Government of Syria Tribal Meeting

Aleppo Governorate, Syria: On June 20, media and local sources indicated that the Government of Syria’s Head of Military Security in Al-Hasakeh Governorate, Mohamad Jandouli, had convened a meeting in Aleppo city with tribal representatives from northeastern Syria. Local sources reported that among those invited to the meeting were sheikhs from the Tay, Bani Issa, Sharabeen, Ma’amera, and Jbour tribes. The meeting echoed the content of previous Government of Syria–sponsored tribal conferences, in that it called for the restoration of the Syrian state in northeastern Syria and hailed the role of northeastern tribes in “combatting terrorism.” Relatedly, on June 22, the general commander of the SDF, Mathloum Abdi, reportedly stated that the Self-Administration has two main demands in any negotiation with the Government of Syria: first, that the latter recognizes the seven administrative units within the Self-Administration; second, that the SDF are maintained as a distinct and separate entity within the Syrian military. Abdi also reiterated the Self-Administration’s willingness to negotiate with the Turkish government.

Analysis: The race to court tribal allegiance in northeastern Syria continues to looms as one of the major issues dictating the Self-Administration’s political future in Syria. Tribal conferences and meetings have regularly been hosted by numerous national and international actors following the defeat of ISIS in northeastern Syria. Indeed, as noted in last week’s Syria Update, both the U.S. and Saudi Arabia have begun to increasingly lobby tribal leaders in northeastern Syria to support the SDF and the Self-Administration. However, it should be noted that despite recent Saudi and U.S. efforts, the Syrian and Turkish governments have both forged much more longstanding ties with tribal leaders in northeastern Syria, and many Arabs in northeastern Syria have serious and legitimate grievances against the Self-Administration. In any negotiations between the Self-Administration and the Government of Syria on the political future of northeastern Syria, the latter will continue to use its longstanding relationships with tribal leaders as a major point of leverage.

4. Chinese Support for Transportation

Damascus City, Syria: On June 20, several media sources reported that the Chinese government provided the Government of Syria with a total of 100 new public buses, in addition to a group of Chinese technical support personnel to train Syrian employees on the technical operation and management of these buses. Notably, in March 2019 China also provided the Government of Syria with 100 new buses, as well as a grant of 100 million yuan (~$14,500,000).

Analysis: Chinese support for the Government of Syria has thus far been relatively limited in scope and scale. However, all instances of Chinese support for the Government of Syria should be taken in the context of potential steps toward future large-scale Chinese investment in Syria; the latter, alongside many countries in the Middle East, are likely to be important parts of the Chinese “Belt and Road” infrastructure plan. Indeed, China has already clearly indicated that it intends to participate to some degree in Syria’s reconstruction, as a part of its broader investment in transportation in the Middle East. Most recently, President of China Xi Jinping reiterated China’s economic interest in Syria’s reconstruction during the Belt and Road Initiative (BRI) Forum, held in Beijing in April. Chinese investment in Syria will likely become an important component of Syria’s reconstruction; indeed, China will likely directly invest in the country’s infrastructure and will also to some degree complement Russian and Iranian initiatives in Syria’s private sector and natural resource industries.

5. Four Seasons Hotel

Damascus city, Syria: On June 19, the Four Seasons hotel chain announced the termination of its management of the Four Seasons in Damascus city. The statement made by the Four Seasons did not include the reason for its decision. However, the U.S. Treasury Department recently sanctioned Syrian businessman Samer Foz along with several of his companies, including the Four Seasons Damascus. Media sources quoted an employee of the hotel, who asserted that the hotel would continue operations and that rooms were still available for booking at ~$545 per night. The hotel is the property of the Syrian-Saudi Company for Touristic Investments, initially a joint venture between Saudi Prince Al-Waleed bin Talal, the Government of Syria, and the Kuwaiti Syrian Holding Company. However, in March 2018, Al-Waleed bin Talal sold his 55 percent stake in the property to Samer Foz. Of note: UN agencies contracts with the Four Seasons Damascus were worth at least $6,933,260 in 2018 alone, according to the Syria Report. A UN public information officer in Damascus, Fadwa Baroud, stated that “while unilateral and multilateral economic restrictions have been adopted by some governments and organisations against entities and individuals in Syria, the UN is only required to abide by the UN Security Council’s sanctions regimes.”

Analysis: It remains unclear under what brand or management the (former) Four Seasons Damascus hotel will operate in the future. However, hotel services will certainly continue, as the hotel is the primary hotel used by international diplomats, aid workers, and UN staff. However, the decision of the Four Seasons brand to terminate its affiliation with the Damascus branch raises concerns that other international companies could take similar measures. The specific sanctioning of Samer Foz could mean trouble for the future of Al-Baraka Bank in Damascus, for instance. Al-Baraka Bank is a major regional bank and the largest banking corporation in Bahrain (where it is headquartered). The bank has not been specifically sanctioned, but Foz recently became a major stakeholder in it—a fact that was mentioned in the recent U.S. sanctions. Critically, many national and international NGOs working in Syria, including the Syrian Arab Red Crescent and Syria Trust, hold the majority or the entirety of their funds in Al-Baraka Bank. Should Al-Baraka Bank decide to withdraw its management of the Damascus branch for fear of future sanctions, the Damascus-based humanitarian and development response would likely be severely impacted, at least temporarily.

6. Qaboun Urban Planning

Qaboun neighborhood, Damascus city, Syria: On June 19, media reports indicated that the Damascus Governorate Council had agreed to change the zoning of the Qaboun neighborhood, in northeastern Damascus, from an industrial and agricultural area to an area “to be considered for future construction and planning.” The council will reportedly begin to investigate individual property claims and appeals over the next month. Following the appeals period, plans for Qaboun will be submitted to the Damascus Governorate Executive Council and the Ministry of Local Administration, which will begin to ratify regulatory procedures under the dictates of Law 10 (2018). Notably, the council also assigned the Damascus Holding Company, the primary ‘reconstruction focused’ in Damascus and the development company which is overseeing the Marota City project in southeastern Damascus, to exclusively manage the implementation of the Qaboun master plan and all attendant contractual entities.

Analysis: Several stakeholders held critical economic interests in Qaboun and had diametrically opposed visions for the future rehabilitation or redevelopment of the area. In general, these stakeholders differed over the degree to which Qaboun should be restored to its pre-conflict state or redeveloped entirely. Qaboun was previously comprised of a large industrial area and a collection of informal and formal housing areas. Several stakeholders, most notably the Damascus Industrial Chamber, wished to see Qaboun rehabilitated and its industrial sector restored. However, other important economic stakeholders—including Mohamad Hamsho, an important businessman with links to President Assad—reportedly wished to entirely redevelop Qaboun, since the neighborhood is likely to become lucrative real estate due to its location at the entrance of northeastern Damascus. The status of the urban planning in Qaboun had been effectively frozen for several months due to these clashing visions of the future of the area. However, the aforementioned change of zoning in Qaboun effectively means that these disputes have now been resolved; Qaboun will be largely “redeveloped.” In this case, “redeveloped” is likely to mean “entirely demolished and rebuilt, tabula rasa.” Notably, as per the 2004 Syrian census, nearly 90,000 individuals lived in Qaboun’s formal and informal neighborhoods; it is highly unlikely that these individuals will ever return to Qaboun.

7. Self-Administration’s ‘Self-Defense Law’

Ein Issa, Ar-Raqqa Governorate, Syria: On June 22, media and local sources indicated that the General Assembly of the Self-Administration had ratified the “Self-Defense Law.” This law lays out the requirements, exceptions, and legal procedures for military conscription within Self-Administration-controlled areas of northeastern Syria. Among the most important points in the law is the age of eligibility for military service, which will span from 18 to 40. However, Article 14 of the law stipulates that the age range to be applied will be decided at the local administrative level. Local sources indicate that the new conscription laws will thus be applied differently in different areas: for example, in Al-Hasakeh and Ein El-Arab, individuals born before 1986 will be exempt; in Menbij, individuals born before 1988 will be exempt; and individuals born before 1990 will be exempt in Deir-ez-Zor and Raqqa.

Analysis: SDF conscription is widely unpopular across northeastern Syria and has been a point of contention between the administration and the local communities. The newly issued law is likely to drastically exacerbate these tensions. Essentially, the new law is being applied differently in different areas, as the age of conscription is determined on the local level; thus, a 31-year-old man from Al-Hasakeh will be conscripted while a man of the same age from Ar-Raqqa will not. This dynamic is likely to lead to considerable resentment between communities facing different conscription policies. The issuing of an official conscription law highlights the Self-Administration’s policy of creating a separate legal code in northeastern Syria. Notably, Self-Administration administrative procedures have generally existed in parallel with the Government of Syria’s—thus presenting a direct challenge to the sovereignty of the Government of Syria. Naturally, this will present significant challenges in any negotiations between the Self-Administration and the Government of Syria. Should the Self-Administration rejoin the Government of Syria in some capacity, for instance, it is unclear whether military service under the SDF would count toward Government of Syria military service requirements.

8. U.S.-Russia-Israel Trilateral Summit

Jerusalem, Palestine: On June 23 and 24, U.S., Russian and Israeli officials held a meeting in Jerusalem, during which they discussed Iranian involvement in Syria. In attendance were the three countries’ top security advisors: U.S. National Security Advisor John Bolton, Israeli National Security Advisor Meir Ben-Shabbat, and Russian Secretary of the Security Council Nikolai Patrushev. Media reports suggested that both Israel and the U.S. were expected to negotiate with Russia to curb the Iranian presence and role in Syria, but it remained unclear what both countries would offer in return. Other media sources indicated that the U.S. would likely present a plan to Russia whereby it would facilitate the implementation of UN Resoution 2254, which calls for a political settlement in Syria, and assist in “combatting terrorism” in exchange for a lessened Iranian role in Syria. The outcome of the meeting has not yet been made public.

Analysis: The unprecedented meeting between the U.S., Russia, and Israel is an indication of the continued U.S. and Israeli focus on the Iranian role in Syria. Both Israel and the U.S. are likely to attempt to convince, or compel, Russia to try to reduce Iranian influence in Syria. However, it is important to note that these efforts are unlikely to have any major impact; even if Russia intended to reduce Iran’s influence in Syria, there are no guarantees that it would be able to do so. Indeed, various Russian attempts to curb Iranian influence in Syria have thus far had limited and negligible outcomes. In fact, over the past several months, Iranian influence on local security and political bodies in areas such as southern Deir-ez-Zor, southern Syria, and Rural Damascus has reportedly increased.

The Wartime and Post-Conflict Syria project (WPCS) is funded by the European Union and implemented through a partnership between the European University Institute (Middle East Directions Programme) and the Center for Operational Analysis and Research (COAR). WPCS will provide operational and strategic analysis to policymakers and programmers concerning prospects, challenges, trends, and policy options with respect to a conflict and post-conflict Syria. WPCS also aims to stimulate new approaches and policy responses to the Syrian conflict through a regular dialogue between researchers, policymakers and donors, and implementers, as well as to build a new network of Syrian researchers that will contribute to research informing international policy and practice related to their country.

The content compiled and presented by COAR is by no means exhaustive and does not reflect COAR’s formal position, political or otherwise, on the aforementioned topics. The information, assessments, and analysis provided by COAR are only to inform humanitarian and development programs and policy. While this publication was produced with the financial support of the European Union, its contents are the sole responsibility of COAR Global LTD, and do not necessarily reflect the views of the European Union.